Govt payroll calculator

Most employers use this paycheck calculator to calculate an employees wages for the current payroll period. Ad Compare This Years Top 5 Free Payroll Software.

Payroll Word On Notepad With Calculator On Color Background Stock Photo Alamy

Get Started With ADP Payroll.

. The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees. Use this tool to calculate holiday entitlement for. Federal Employees Group Life Insurance FEGLI calculator.

Part of a leave year if the job started or finished part way through the year. Take a Guided Tour Today. All Services Backed by Tax Guarantee.

Thats where our paycheck calculator comes in. Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. Ad Paycors All-In-One HR Solution Streamlines Every Aspect Of Your Organization.

Use our PAYE calculator to work out salary and wage deductions. The EX-IV rate will be increased to 176300. Estimate your federal income tax withholding.

See How Paycor Fits Your Business. Search the IFSC code. Free Unbiased Reviews Top Picks.

CGE Holiday 2022 PDF. Discover ADP Payroll Benefits Insurance Time Talent HR More. Open with Maximum Telework Flexibilities to all current telework eligible employees pursuant to direction from agency heads.

See how your refund take-home pay or tax due are affected by withholding amount. 5304 g 1 the maximum special rate is the rate payable for level IV of the Executive Schedule EX-IV. Department of Personnel and Training has issued various instructions from time to time on pay fixation of Government servants.

Our 2022 GS Pay. Form TD1-IN Determination of Exemption of an Indians Employment Income. We calculate salaries based on the.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Expected DA From July 2022. Regarding the pay rates this calculator produces for grades GS-1 through GS-4 for locations within the United States please be aware that beginning on the first day of the first applicable.

Ad Paycors All-In-One HR Solution Streamlines Every Aspect Of Your Organization. Please use our Advanced Calculator to calculate your net pay or. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Take a Guided Tour Today. The Federal Wage System FWS payscale is used to calculate the hourly wages for millions of blue-collar Government workers. A full leave year.

See How Paycor Fits Your Business. Enter your employees pay information. Employers and employees can use this calculator to work out how much PAYE.

Important note on the salary paycheck calculator. We hope these calculators are useful to you. If youre checking your payroll.

2022 Annual Pay w locality 2022 Bi-weekly Pay. Deductions from salary and wages. CGHS Rate list PDF.

7th Pay Commission Calculator. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Ad Process Payroll Faster Easier With ADP Payroll.

Free Unbiased Reviews Top Picks. Our powerful General Schedule Salary Calculator can help you determine government salaries for any location in the United States. Welcome to the FederalPay FWS Pay Calculator.

Welcome to the FederalPay GS Pay Calculator. Get Started With ADP Payroll. General Schedule GS Salary Calculator.

Calculate the premiums for the various combinations of. Ad Payroll So Easy You Can Set It Up Run It Yourself. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

Ad Compare This Years Top 5 Free Payroll Software. Determine the face value of various combinations of FEGLI coverage. If payroll is too time consuming for you to handle were here to help you out.

When you choose SurePayroll to handle your small business payroll. Ad Process Payroll Faster Easier With ADP Payroll. How It Works.

Use this tool to. Now updated for 2022. Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer.

Ontario Tax Brackets For 2022 Savvynewcanadians

7 Best Payroll Calculators In Canada Canada Buzz

How To Calculate Payroll Taxes Taxes And Percentages

How To Calculate Provident Fund Online Calculator Government Employment

Check Out Dnd S Pay And Overtime Calculator Canada Ca

Payroll Time Conversion Chart Payroll Calculator Decimal Time

38 Debt Snowball Spreadsheets Forms Calculators In 2022 Payroll Template General Ledger Project Management Templates

Taxes For Freelancers And Self Employed Workers In Germany

![]()

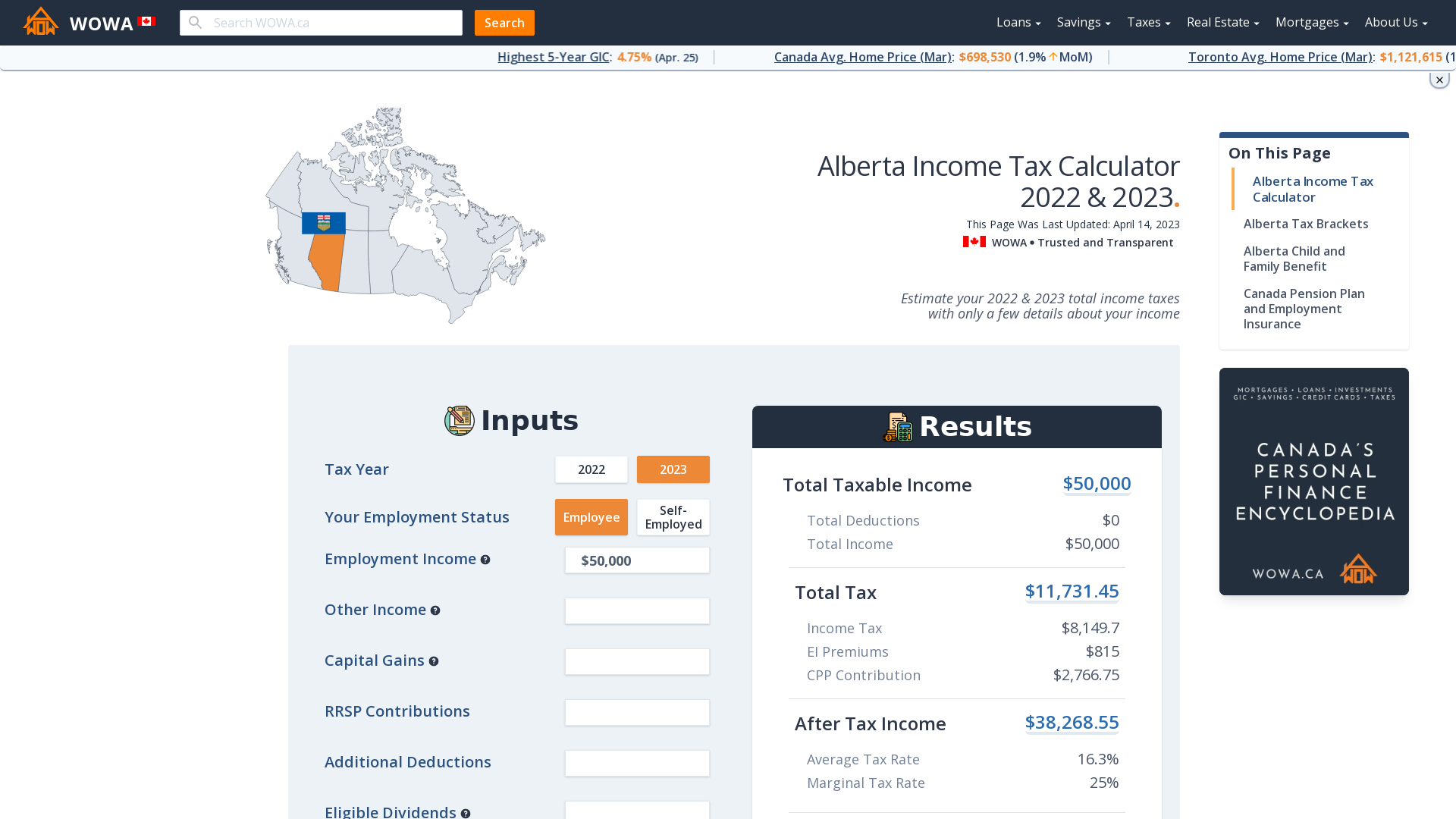

Canada Income Tax Calculator Your After Tax Salary In 2022

What Are The Required Payroll Deductions In Ontario Filing Taxes

Free Tally Erp 9 Course Computer Education Social Media Optimization Computer Basic

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Alberta Income Tax Calculator Wowa Ca

How To Calculate Net Pay Step By Step Example

Mathematics For Work And Everyday Life

How To Calculate Payroll Tax Deductions Monster Ca

2021 2022 Income Tax Calculator Canada Wowa Ca